© 2020 by Peter Coe Verbica

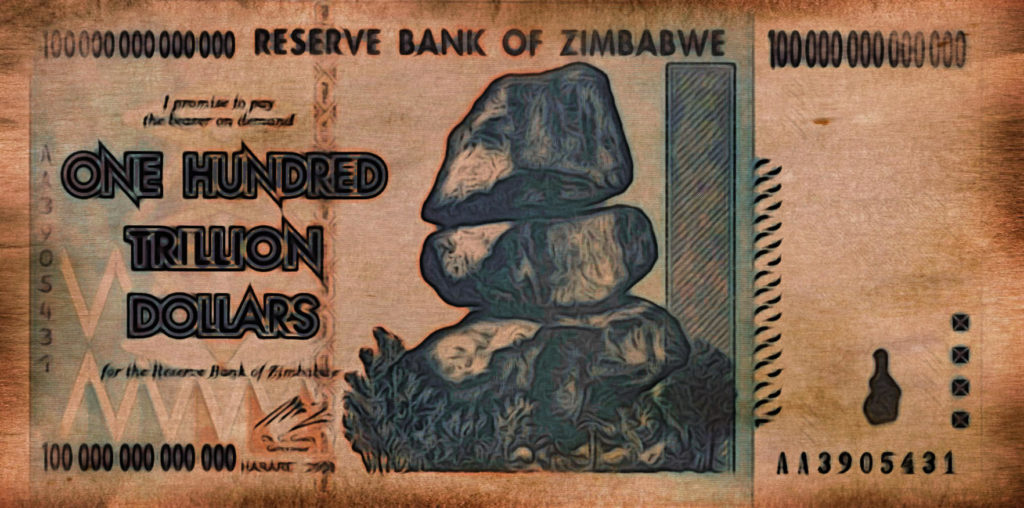

A few years back, I sat down in Hon. George Shultz’ office at the Hoover Institution to seek the US Marine’s advice. His office included photographs which evidenced his close and lifelong friendship with Ronald Reagan, our 40th President. Along with the myriad of books which lined his workplace, I noticed the rectangle of paper currency in a small frame. The bill had an image of balancing rocks as its center piece. I recognized the large denomination immediately, as I had a similar one in my collection. I wasn’t surprised to see that Secretary Shultz also understood the irony and consequences of fiat currency issued with capriciousness. In addition to serving as Secretary of Labor, Director of the OMB, Secretary of State, Shultz also held the office of the 62nd US Secretary of the Treasury. Though the reserve note stated a value of “One Hundred Trillion Dollars,” I knew that its significance was for its novelty, rather than any backing by its original issuer, the government of Zimbabwe. One of Shultz’ favorite sayings is “Trust is the coin of the realm.” Since he had the unenviable responsibility of decoupling the US Dollar from the gold standard during the Nixon administration, I can understand why it would be of profound relevance to the Secretary.

While we are on the topic of trust: many students, especially those who have studied economics, are familiar with the ill-fated consequences of the Weimer Republic inflating its currency to a point where wallets were replaced by wheelbarrows. The policy was a response to Germany’s being saddled with post-WW I debt reparations, but France also used the same strategy when it was saddled with debt during the late 1700’s. After nationalizing land which had been formerly held by the Church, the French government decided to issue paper currency to satiate its borrowings. While gold and silver coins had some intrinsic value associated with their alloys, the new paper money would be guaranteed by the good faith of the French people and the wise stewardship of its government. Andrew D. White wrote about how lofty ideals met with ugly consequences in his 1882 treatise, Paper Money, Inflation in France, How It Came, What It Brought and How It Ended:

“The truth which it brings out with great clearness is that doubling the quantity of money or substitutes for money in a nation simply increases prices, disturbs values, alarms capital, diminishes legitimate enterprise, and so decreases the demand both for products and for labor; that the only persons to be helped by it are the rich who have large debts to pay.”

The more recent supernova example of hyperinflation and currency devaluation is the country of Venezuela. Despite its being resource rich (reportedly ranking number one in oil reserves and having cash crops such as cocoa and coffee), its citizens have been ground down into abject poverty under the heel of an autocratic Socialist. The country’s hyperinflation would confound most handheld calculators and strains the imagination. In 2019, the International Monetary Fund pegged the projected inflation rate at 10,000,000%.[i] Resourceful street vendors in Bogota and elsewhere have determined a higher and better use for the near-worthless currency: women’s handbags. One enterprising vendor, who learned the technique of making textiles out of paper in prison, praises the valueless Venezuelan banknotes’ qualities of durability and water repellence.

Is concern about such ephemeral esoterica such as the U.S. national debt best left to conspiracy theorists and wearers of tinfoil hats? With the estimated U.S. national debt clocking in at $23,692,367,201,235 at 10:03 am this morning on April 3, 2020, perhaps the rest of us should begin to ring alarm as well. Additional metrics show the U.S. debt ratio at 109.37% to the GDP; to put things in perspective, it’s more than double the figure of 53.05% in 1960. Debt per taxpayer weighs in at $191,172.[ii] Valentin Schmid warns, “This means that everyone who wants to protect their savings must become a financial speculator, as simply holding U.S. dollars will lead to a guaranteed loss of purchasing power.” (“Inflation, a Hidden Tax,” Epoch Times). Adding to the current monumental debt burden, bipartisan leaders in DC have burdened their printing presses even further with the hasty passing of a $2 Trillion Dollar Coronavirus Stimulus Package. Cash may have once been king, but in today’s sick world, it could very well end up the joker.

[i] https://en.wikipedia.org/wiki/Hyperinflation_in_Venezuela#cite_note-IMF-15